how much is capital gains tax in florida on stocks

The amount of taxes youre responsible. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Six months later the price of the stock rises to 65 per share.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. The capital gains tax is based on that. If your taxable income is less than 80000 some or all of your net gain may even be taxed at. As with other assets such as stocks capital gains on a home.

Capital Gains Taxes on Property. Ncome up to 40400. The sale price minus your ACB is the capital gain that youll need to pay tax on.

Individuals and families must pay the following capital gains taxes. Excise and Consumption Taxes. Therefore if you receive capital gains in florida there is no tax regardless if section 1202 100 tax exclusion on capital gains from the sale of qsbs applies.

There is no Florida capital gains tax on individuals at the state level and no state income tax. You sell your entire position for 6500 producing a 1500 gain on sale. Federal-level capital gains tax Despite the absence of capital gains tax required by the state Floridians are still subject to federal taxes.

Long-term capital gains tax on stocks. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Therefore if you receive capital gains in florida there is no tax regardless if section 1202 100 tax exclusion on capital gains from the sale of qsbs applies.

For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. The 5000 purchase price of the stock. You may have just sold a stock for a 20 gain but after state and federal taxes your gain may.

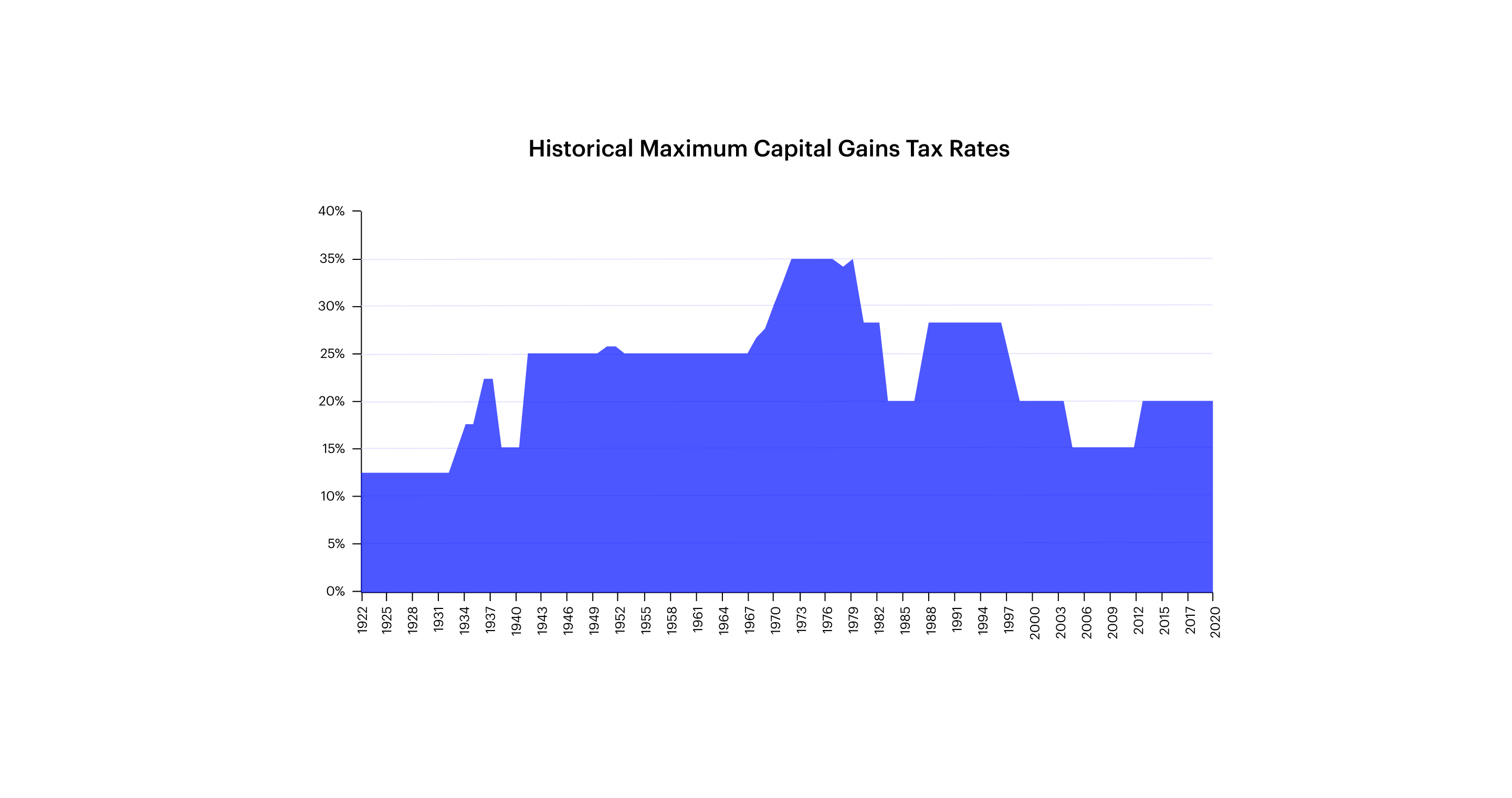

Youll pay taxes on your ordinary income first and then pay a 0 capital gains rate on the first 33350 in gains because that portion of your total income is below 83350. Under the Tax Cuts Jobs Act which took effect in 2018. A big negative of capital gains taxes is that they cut into your return on investment.

If you have a short-term gain it will. In our example you would have to. Long-term rates are lower with a cap of 20 percent in 2022.

If you own a home you may be wondering how the government taxes profits from home sales. Florida Capital Gains Taxes. The capital gains tax on most net gains is no more than 15 percent for most people.

What You Need To Know 2022. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

Specifically New Hampshire imposes a 5 tax on dividends and interest while Tennessee charges a 6 tax on investment income in excess of 1250 per person. If your cost is less than the sales price you have a capital gain. An allowable capital loss is 50 of a capital loss.

Your long-term gain will be taxed at 0 15 or 20 depending on your income. Capital gains tax florida stocks. If your income is between.

In Canada 50 of the value of any capital gains is taxable. When allowable capital losses exceed taxable capital gains in a year the difference is the net capital loss for the year. The 1012 Tax Bracket.

Federal long-term capital gain rates depend on your. For single filers with income lower than 40400 youll pay zero in capital gains taxes.

Guide To The Florida Capital Gains Tax Smartasset

Capital Gains Tax In The United States Wikipedia

Restricted Stock Units Jane Financial

Taxes And Insurance Greenbacks Magnet

Business Capital Gains And Dividends Taxes Tax Foundation

Capital Gains Tax Rate 2022 How Much Is It Gobankingrates

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Tax Calculator Estimate What You Ll Owe

Indexing Capital Gains Basis For Inflation Florida Chamber Of Commerce

Easiest Capital Gains Tax Calculator 2022 2021

Capital Gains Tax What Is It When Do You Pay It

Florida Capital Gains Tax The Rules You Need To Know Home Bay

Capital Gains Full Report Tax Policy Center

Capital Gains Tax Calculator Real Estate 1031 Exchange

Here S How Stock Trading Profits Are Taxed Money

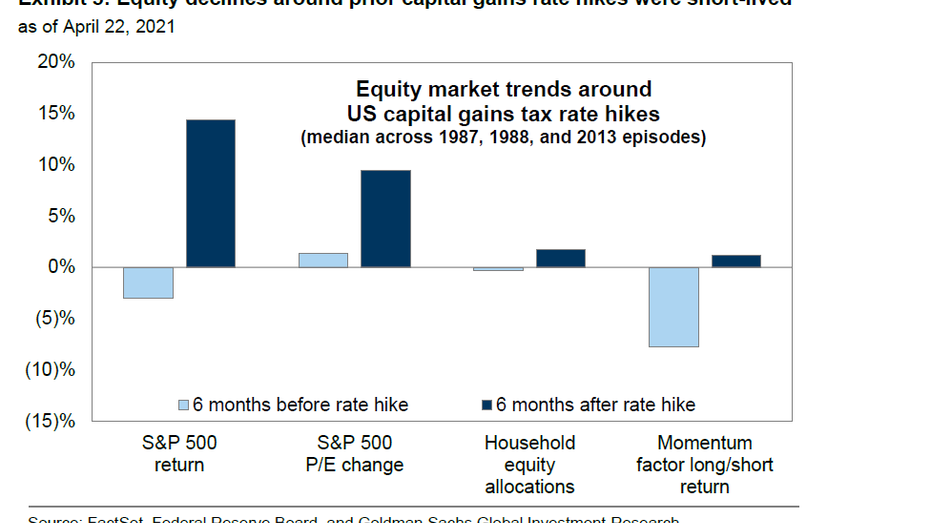

Goldman Says Biden Capital Gains Tax Hike Could Trigger Some Stock Selling But It Won T Last

Capital Gains Tax Hikes And Stock Market Performance Fox Business